Sometimes you are willing to trade so much that the irritating factors do not matter for you. You want to get into a fight and consider these factors to be unimportant, although they are. And in some cases these factors may play a bad trick on you, making your pockets much thinner. In this article, we consider the major factors that should make you think twice while entering the market. Before reading it, make sure you understand the basics of trading and risk management and the ways to secure your deposit.

Chaos in the market

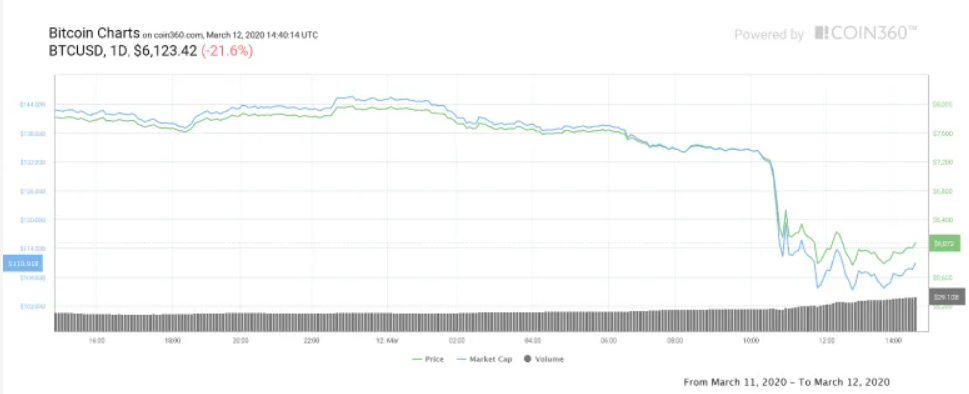

Sometimes the market appears to act inadequately, in an inexplicable manner, no matter how many reasons you are trying to find in vain (for example, after harsh crashes of the market, like it was on March, 13 in 2020).

In these cases, when you have no clue what is going on, it would be wiser to step aside and wait for a while. Probably, you’ve missed some news or there was a leak of information and did not catch the trend. Or it can happen after the bad news when the market simply does not know how to react to it. So, just stay away.

News

The news may bring both jackpot and sad losses, that is why sometimes it is better to avoid trading on the eve of the report releasement or any other predicted event date, as the price spikes in both directions are not a rare thing during these events, and then the market comes back to normal volatility. No doubt, you can earn on these movements, but be aware that trading the news is also risky. It is a well-known fact that traders:

Buy on rumors and sell on the news.

It is explained by the fact that the price is driven not by real numbers from the reports but the investors’ expectations. That is why it is recommended not to trade in the hour before and after the news announcement. Sometimes even a day before and after. You may consider it to be too much, but just imagine that one insignificant piece of news may deprive you of a lot of money. Solid experience is needed to trade the news.

Events and speeches

Obviously. For example, ard and soft forks can influence a market conjunction a lot. Some speeches can change the expectations of investors, and what if there is a whale among them? That is why the major events are also risky in terms of price volatility in the whole market or by sectors.

Just remember how Donald Trump may shake the price!

Emotional stability

It is one of the most important integral parts of successful trading. Always pay enough attention to it, and if you are a bit messed up and cannot concentrate, it is better to wait for better times. It can be not only your internal factors but also external ones, like negative circumstances or any other sidetracking things. Better to evaluate your emotional stability and then decide if to trade or not to trade.

Generally, you can have your own reasons not to trade and it is normal. It happens, for instance, if your ordinary biorhythm is disrupted. You may be gushed with the runaway emotion, which can result in negative trading outcomes, but what is good here is that everyone is able to keep in control of it, at least partially, in contrast to the external factors, which we cannot manage. The most effective option here is to deal with them in the right way and analyze, no way ignoring it. Otherwise, you may put your deposit in danger.

Thus, avoid trading basing on emotions, be it hope, greed, anger and so on. Read here about dealing with your emotions if you lose in trading to ensure you keep in control of your earnings! Besides, get some insights on emotions intrading in comparison to poker. Get surprised how similar they are and use your knowledge in your strategy.

Sidetracking factors

Trading is also a job and, as every work requires, it needs concentration on the process to get the job done well. To illustrate, you are waiting for a trading signal to open a trade, but then you have your milk boiling over, or a dog jumping on your keyboard. You are getting distracted and then, coming back to trading you see that you lost the perfect moment to enter the market. Your undivided concentration can cost a lot for you! That is why such simple things, such as getting rid of sidetracking factors and warning others about your working hours, may benefit you a lot. Don’t let them break your trading plan!

These are some tips on how to choose the right time to trade. Get more info on the ways to improve your trading with the help of your own psychlogy and dive into a fascinating world of risk management!

By the way, do you have some other rules when to trade and when to stay away from it?

Stay tuned and join our social media:

Telegram: https://t.me/bitinsurecom

Facebook: https://www.facebook.com/bitinsure

Twitter: https://twitter.com/bitinsure_news