When it comes to cryptocurrency trading, we face a self-evident truth that humans aren’t infallible in making money on it. This was the major reason for trading bots to steal the show long ago. Fast, automated, round-the-clock perfect earners!

So, you bought this precious bot and get your first $100 a week. Probably your thoughts are “Great! I will be rich. ” However, three-month pass and you end up with a $2,000 loss. You are still cheerful about your bot, thinking that it was just a bad streak of luck. You say “I’ll keep going because I’ve already seen how reliable my bot is”. But wait, is it really?

This happens again, and again, and again with many traders. Indeed, the bots are able to earn money, but, unfortunately, their life cycle is limited. Trading bots do die and do screw up like people. That is why one day your bot may turn out to be ineffective, even though it was demonstrating outstanding results for a long time. Remember that the previous results of the trading bot cannot guarantee you a profitable future. Why?

First of all, you need to understand one obvious fact. The market is changing and more people see the inefficiencies you earn from, making them less profitable. That is why, after some time any strategy and bot, even a genius one, becomes useless. Usually, approximately in 80% of cases, this happens starting with a long-term “zero” profit, which smoothy leads to gradual losses (read about how to deal with losses here). The remaining 20% of the bots may surprise you by a sudden abrupt drawdown which exceeds all limits you imposed. The profitability is also restricted by the scaring range of risks that various bots bear. Here is an overview of some.

Pair trading, investing bots and bots using indicators

All these bots are based on different patterns confirmed by time (historical evidence). Pair trading implies that the assets have a high correlation coefficient (does not matter direct or reversal), therefore, the price movements can be predicted basing on the previous correlation results. As for investing bots, they are supposed to compose an earning and efficient portfolio to have constant passive income, basing on historical performance of the assets. The indicator bots as well use some assumptions considering price movements and volumes patterns proven by the cases from the past.

Irrational market behavior

The key word and danger here is “past”. Remember that the time is not your best adviser in this case. As soon as the asset dynamics becomes different, the correlation proven by the time vanishes, while a trader is still hoping to get the usual profitability but suffers losses. This happens often at extremum peaks or bottoms, as they are a common sign of the upcoming changes in the market state.

Exactly the same happens with indicators evidence, which becomes useless immediately even with the minor change in asset behavior. The logic is broken so easily, making a bot useless. As you understand, the frequent changes are typical of the crypto world. Then how can we rely on investing bots in the long term? The market may change in the manner you would never even imagine! In brings Black Swans and crashes, giving birth or killing assets in a matter of hours. Therefore, these bots extremely short-term fragile earners. Sometimes it’s even better not to trade during such irrational market behavior.

Trend bots

Obviously, trend bots work with trends. They are aimed at catching huge movements, having an entry point at the right moment and then the inflow of profit is brought to your account. Here we face another problem. What if there is no trend at all?

Unsuitable market state

Firstly, we can get stuck in long-term drawdown because trading bot simply is not adapted to earn on a flat market. Thus, you can suffer losses until a trend comes. However, you never know when exactly this will happen. Your only option is to wait obediently and hope at least to survive in this market, which, unfortunately, can stay irrational longer than you can stay solvent, as John Maynard Keynes said. Then ask yourself if you are ready to have a drawdown during, let it be, half of the year?

Secondly, being in a long-term flat market you may miss the moment when the market state has changed so much that bot algorithms are not working anymore. Again you never know if you are in ‘normal’ drawdown, or probably something went wrong with the bot.

Pair trading, investing bots and bots using indicators

All these bots are based on different patterns confirmed by time (historical evidence). Pair trading implies that the assets have a high correlation coefficient (does not matter direct or reversal), therefore, the price movements can be predicted basing on the previous correlation results.

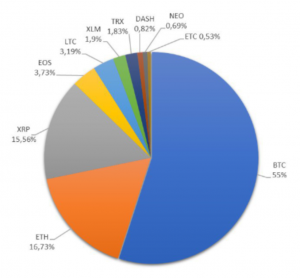

As for investing bots (or robo-advisors), they are supposed to compose an earning and efficient portfolio to have constant passive income, basing on historical performance of the assets. Example is below:

Investment portfolio example

Read about investing rules and prculiarities here.

The indicator bots as well use some assumptions considering price movements and volumes patterns proven by the cases from the past.

Irrational market behavior

The key word and danger here is “past”. Remember that the time is not your best adviser in this case. As soon as the asset dynamics becomes different, the correlation proven by the time vanishes, while a trader is still hoping to get the usual profitability but suffers losses. This happens often at extremum peaks or bottoms, as they are a common sign of the upcoming changes in the market state.

Exactly the same happens with indicators evidence, which becomes useless immediately even with the minor change in asset behavior. The logic is broken so easily, making a bot useless. As you understand, the frequent changes are typical of the crypto world. Then how can we rely on investing bots in long term? The market may change in the manner you would never even imagine! In brings Black Swans and crashes, giving birth or killing assets in a matter of hours. Therefore, these bots extremely short-term fragile earners. Remember the drop of crypto market in 2018? Or in March 2020…?

Arbitrage bots

These bots concurrently trade an unlimited amount of coins across several exchanges. Generally, the profitability of this bot is 20-50%. Seems cool! But what risks are hidden behind the curtains?

Technical risk

The major one is a technical risk. One of the exchanges a bot operates at can be shut down anytime, locking the arbitrage opportunities or interrupting your profitable trade. As a result, you lose. Thus, your profitability depends a lot on technical maintenance or a variety of network errors that influence the work of the exchange.

Scalping bots

These HFT (high-frequency trading) bots make a huge amount of trades with tiny profitability, constantly growing your deposit. And here we have two news, a good and a bad one.

What’s good is that 70-80% of the trades in scalping are profitable which makes a technical risk not so dangerous for these bots. They will recover possible losses quickly, making them not so painful for your budget. As for the bad news, we have some more substantial risks for these bots.

Wrong position sizing

First of all, scalping bot is a powerful machine only in case if you are aware of how to use it. Often traders driven by greed increase the positions finally making them oversized for the bot. This is the right track to make a bot ineffective and, unfortunately, a common mistake of many traders.

Find the ways to optimize the position sizing here!

More quick rivals

Furthermore, as scalping can be considered to be high-speed race of traders, your bot is extremely vulnerable in front of the rivals which may get better and quicker connection (channel). As soon as it happens, any genius strategy is blurred by the speed of the competitor, and you lose again.

These were some illustrations of the trading bots risks. We do not even pay a lot of attention on other risks like small mistake in the code or insignificant bug that instantly kills any strategy. Simply, it turns out to by a “give away” lottery of your money, making you lose your deposit in an hour due to a tiny detail that can bу so insulting and stupid.

Epilogue

As you can see, any bot reaches its “expiration date” or suffers a crash due to this or that risk. It means that the bots themselves may not give you the moon and the stars. The thing is that their entry and exit points, being even super effective and built on the best strategies, are only 20% contribution to your long term profitability. The rest 80% is about comprehensive risk and money management, constant monitoring and enhancing of the bots’ algorithms. Read more about the importance of risk-management strategy in the profitability of trading that can help you stay in-game with the help of powerful math even in case of 100 losses.

Also remember to enhance your risk management for both manual and automated trading with Bitinsure that mitigates risks and automates the routine and “painful” instruments of risk management to enables traders to focus on what matters the most. Read the review here and try it for free!

Stay tuned and join our social media:

Telegram: https://t.me/bitinsurecom

Facebook: https://www.facebook.com/bitinsure

Twitter: https://twitter.com/bitinsure_news